Most social media managers use the data gathered by social media analytics tools to report on performance. But this is just the first step. Reports are only worthwhile if you understand why the results are important and what they’re telling you. That’s where social media benchmarks come in.

They provide the context that raw data lacks by itself. So, let’s take some time to dive into why benchmarking matters in social media and how you can use it to take your brand to the next level.

Contents

What is a social media benchmark?

A social media benchmark is a performance standard that allows you to assess the effectiveness of your strategies and campaigns. Benchmarks are used to compare current performance against a competitor’s results. They allow social media teams to set realistic goals and expectations, and are generally applied in one of two ways:

- Comparing a specific metric against one particular brand.

- Comparing overall performance against an industry-wide average.

When a social media team is tracking their performance against benchmarks, they will likely be looking at a number of metrics. Here are few of the usual suspects, just to give you an idea:

- Campaign performance

- Follower growth rate

- Inbound engagement

- Outbound engagement

- Number of posts published

- Mentions

Just keep in mind that the metrics which hold the most value for you will depend on your brand, your goals, and the strategies you’re using to achieve them.

Why social media benchmarking matters

Social media benchmarks provide you with vital context in multiple areas that will inform what you do and how you do it. Here are a few key reasons why benchmarking is important:

Assess where you stand in the market

Social media benchmarks will help you to build a more complete picture of where your brand currently stands in the market. You can build a set of benchmarks that show who your industry competitors are, their size, which competitors are most relevant to your niche, which platforms they are posting on, how frequently they are posting, and so on.

This provides you with a very clear view on who you’re competing against in the market and how you can use social media to gain an edge for your brand. It will also help you set realistic targets and goals for your social media strategy (because hey, aiming for a 5% monthly Instagram follower growth rate is all well and good, but it might not be the most reasonable ask if your competitors aren’t even cracking 1.5%).

Understand your current performance

The most obvious way in which benchmarks are useful for social media marketers is that they help you to properly contextualize your results. Once you have a good hold on how to use social media metrics in your workflow, benchmarking takes that one step further by asking, “OK so how do my results stack up against everyone else?”

Keep in mind that every brand is different, every industry is different, and every niche is different; so one of the first things you should do is find the benchmarks that will give your results relevance.

Your stakeholders will appreciate the context if you sprinkle some benchmarks into your reporting. After all, a 0.58% engagement rate on Twitter could sound very low to someone who doesn’t work in social media, right? But if they understand that’s 2x the industry average and way better than any competitor achieved last month, well… you’ll get an enitrely different response!

Gain content strategy insights

Using social media benchmarks is a great way to help you to understand how your content resonates with your audience. This can work in two ways:

- Taking note of the content that works really well for your competitors

- Comparing the performance of your current content against your past content

If you benchmark in this way, you’ll find insights on which post types already resonate within your industry or niche, which post types resonate best with your target audience, and even which product or feature announcements gain the most traction.

Identify areas for improvement

But wait, benchmarking is not only about when your content is performing well. You can use it to inform you of things that aren’t going so well too. That’s why it’s so important to track how your content performs overall.

In general, you’ll want to benchmark the average while pinpointing specific pieces that overperform or underperform by a significant margin.

Once you notice a trend, you can take action.

For example, let’s say that you know Instagram stories, TikToks, and YouTube shorts are all good performing post types for your brand. But you’re running a certain campaign where the metrics on those posts are falling short. This can trigger you to dig deeper and try to identify the reason why. Is it the messaging? Is the subject matter not quite aligned to what’s worked in the past? What’s different here and what can you try to improve things?

4 types of social media benchmarks you can use

1. Industry benchmarks

Industry benchmarks are all about looking at the big picture. They serve as inspiration since you’re able to compare how your performance stacks up against the wider industry.

Finding your industry benchmarks is a great starting point, since they will add a lot of important context to your performance. For example, the average engagement rate on Instagram posts in the food and beverages industry is not going to be the same as it is in the banking and financial services industry. So knowing what the average in your space is will give you a clearer idea of what to aim for.

2. Competitive benchmarks

When you narrow the scope down a bit, you find competitive benchmarks. This is when you look at specific competitors who are similar in size, operate within the same niche, or have similar goals to you.

Again, this is all about adding context to your own performance. You’ll want to keep an eye out for how you measure up against key competitors, and if you spot that anyone is outperforming you on an important metric, you can use this as motivation to try and identify what it is they’re doing differently.

3. Personal benchmarks

Personal benchmarks are used to inform your immediate goals by comparing current performance against past performance. For example, you could compare this year’s holiday campaign directly against last year’s, since both would take place for the same reason and at the same time of year.

Since you have more knowledge about the variables at play, you can take important insights away regarding why things worked better in one campaign compared to the other.

4. Audience benchmarks

Audience benchmarks help you validate whether your target audience is aligned with what you know about your brand and how your brand is positioned. You can use specialized tools such as Audiense and SOPRISM to see how relevant your brand is to specific personas.

You can also use audience benchmarking to identify new influencers or ambassadors for your brand.

Looking at an audience benchmarking use case with Audiense and SOPRISM

As we all know, marketing is extremely data-driven these days. Data helps us to develop brand knowledge, run competitive analyses, and gives us access to benchmarks which we can use in various ways.

So, let’s take a look at a use case to see how I would approach using benchmarks. To respect the confidentiality of the project, we’ll just say that we’re looking at Ford and that we’re focusing on their brand in the United States.

I’ll be using Audiense and SOPRISM to find benchmarks that I can use to validate the target audience, the positioning and competitive analysis, and finally the brand strategy.

A quick note on the tools I’m using here. The key differences between Audiense and SOPRISM are:

- The data source: Audiense Insights has a direct connection with Twitter, whereas SOPRISM has a direct connection with Meta

- Audiense uses algorithmic segmentation, with access to more granular data on individual accounts, which is great for discovering and building new segmentations

- SOPRISM uses predefined personas, built from anonymized data of groups of at least 10,000 people, which is great for validating target buyer personas

Study objectives

In our example with Ford, we’ll say that the brand wants to evaluate and validate whether or not it would be a good idea to target the ‘large family’ market segment.

With this in mind, we’ll use the example to try and show:

- How to build digital knowledge around a brand

- How to evaluate new brand positioning

- How to analyze the competition around a specific persona

- How to develop a brand strategy to appeal to the specific persona

Step 1: brand knowledge discovery

Initially, I just want to develop some knowledge around the brand. I’m looking to identify key information about the brand-centric target audience. Some questions I’m asking myself here include:

- Who are the existing fans of the brand?

- Are there any socio-demographic insights I can gain?

- Are there any psychographic insights I can gain?

- What are their lifestyle profiles like?

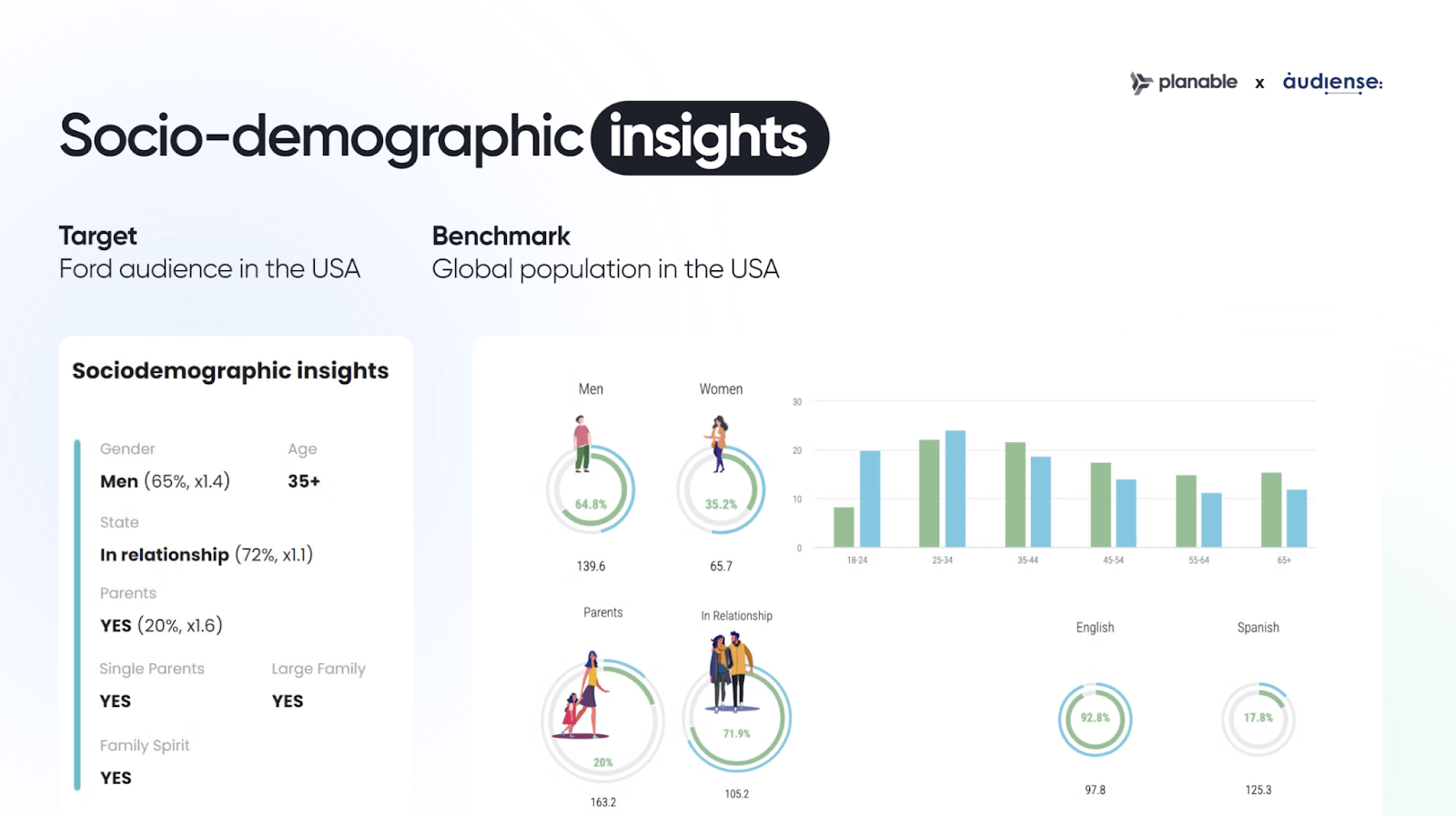

Socio-demographic insights

As I’m on the hunt for socio-demographic insights, I want to select my target which is Ford in U.S. Then, the Benchmark will be the global population in the U.S.

Why the global population? Well, I want to find the most important distinction between Ford and the global population. So it provides me with the basic benchmark to make that comparison in this case.

I can now directly identify in green the Ford penetration and in blue the global population. This tells me if I have an over-indexing or an under-indexing based on different age groups, different genders, relationship status, and so on.

For example, I now know whether language is important or not for the target. In this case, Spanish is very relevant because it’s different between the Ford audience and the benchmark population.

I can also see the same for the age group. For example, every age segment over 35 are more associated with Ford than younger segments of the population.

So with this simple search, I compare my target and my benchmark to identify a few insights to get me started.

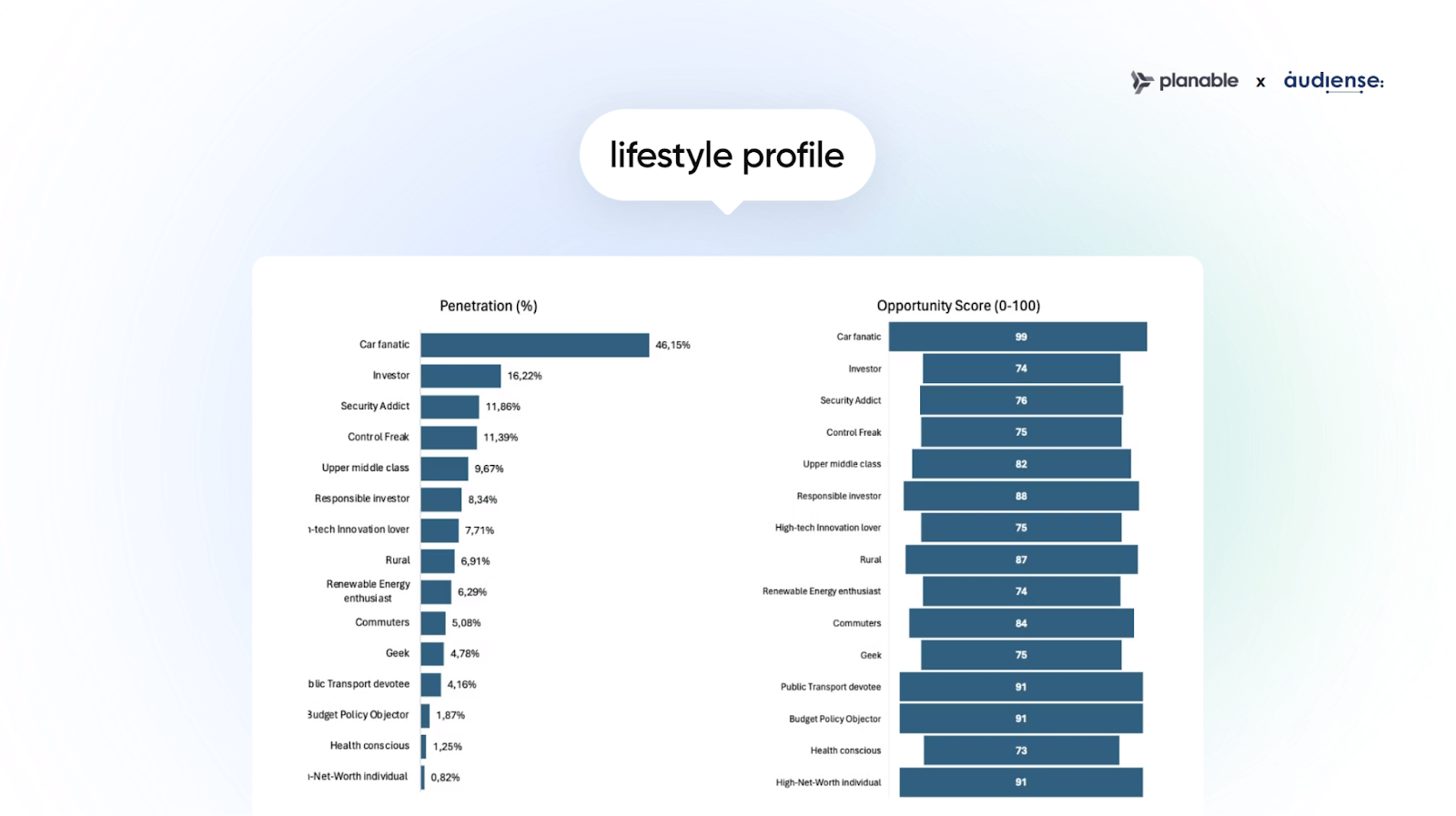

Lifestyle profile

Next, I will do exactly the same exercise for the lifestyle profile. This will help me analyze the penetration percentage and the opportunity score.

The penetration percentage tells me how many people within my target audience have an affinity towards a particular interest, as part of their lifestyle profile. The opportunity score integrates that information with the benchmark to identify the best lifestyles to activate.

If the score is over 60, the opportunity is very high. If it’s under 60, the opportunity may not be so relevant.

For example, we can see the rural lifestyle, along with security addicts and control freaks, are very important for Ford – and also that these align more with Ford than the average population in the U.S.

From this, I can make decisions on how to develop targeted content or campaign messaging.

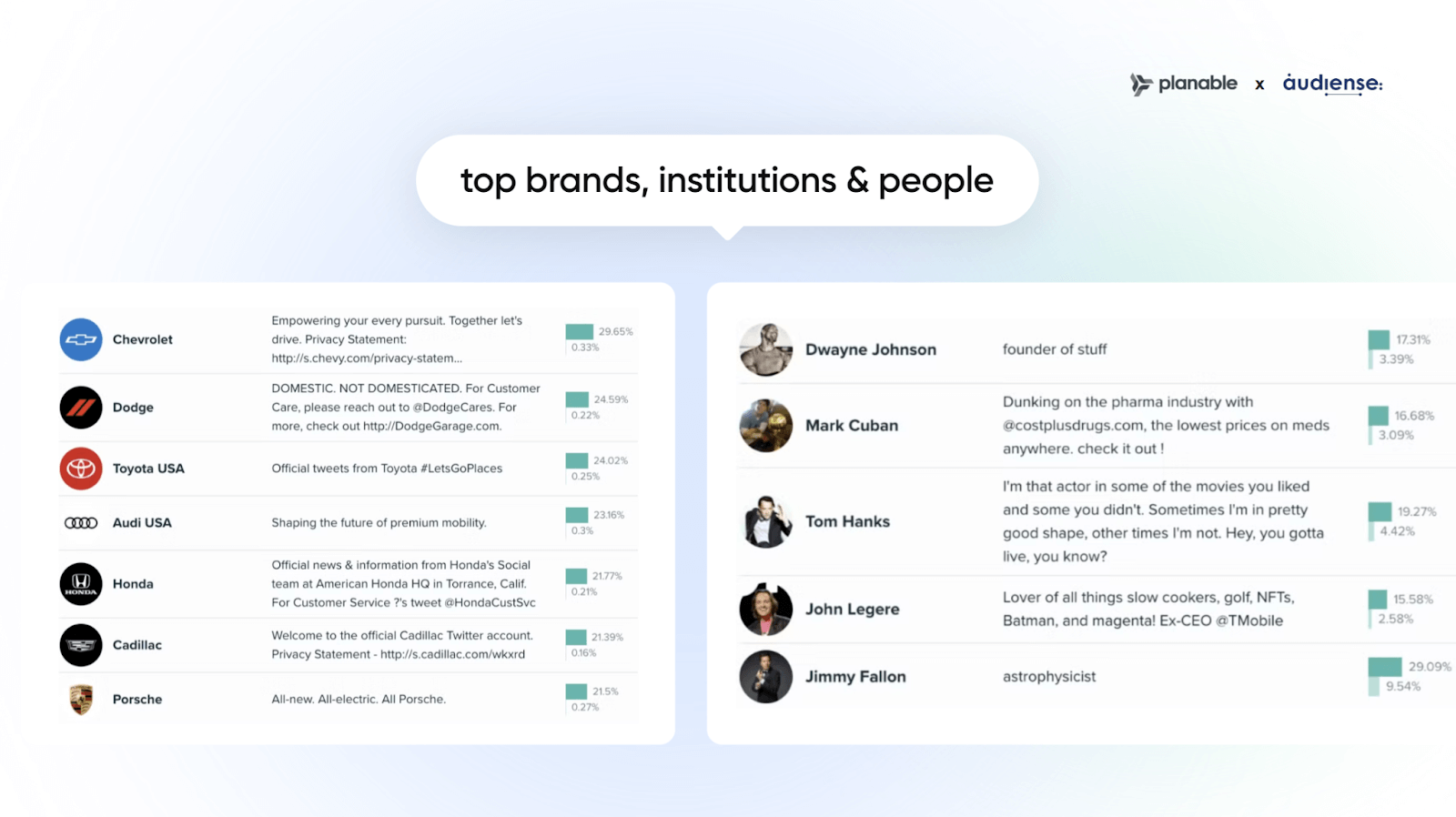

Top brands, institutions, and people

Now I want to do exactly the same thing, but using Audiense Insights. Here the goal is to analyze the overlap between Ford and a competitor like Chevrolet, Dodge, or Toyota.

I can directly identify the penetration and the overlap between Ford and its competitors, and create a list to rank them in order of importance. So, when I’m looking to create targeted content or reach out to a particular influencer or ambassador, I’m doing so in a way that makes the most sense for the brand.

This is also pivotal when it comes to running a competitive analysis. It helps me define the most important competitors for my brand and shows me the benchmark for where each brand overlaps.

Step 2: positioning and competitive analysis

In the first step, I discovered core knowledge about my brand and how it stands against the average U.S. population benchmark. But when I want to position a brand or analyze how it stands against a competitor, I need to modify my Benchmark.

This next exercise will allow me to validate Ford’s brand positioning to the large family segment, as well as telling me whether it makes sense from a competitive analysis perspective.

Target persona relevance analysis

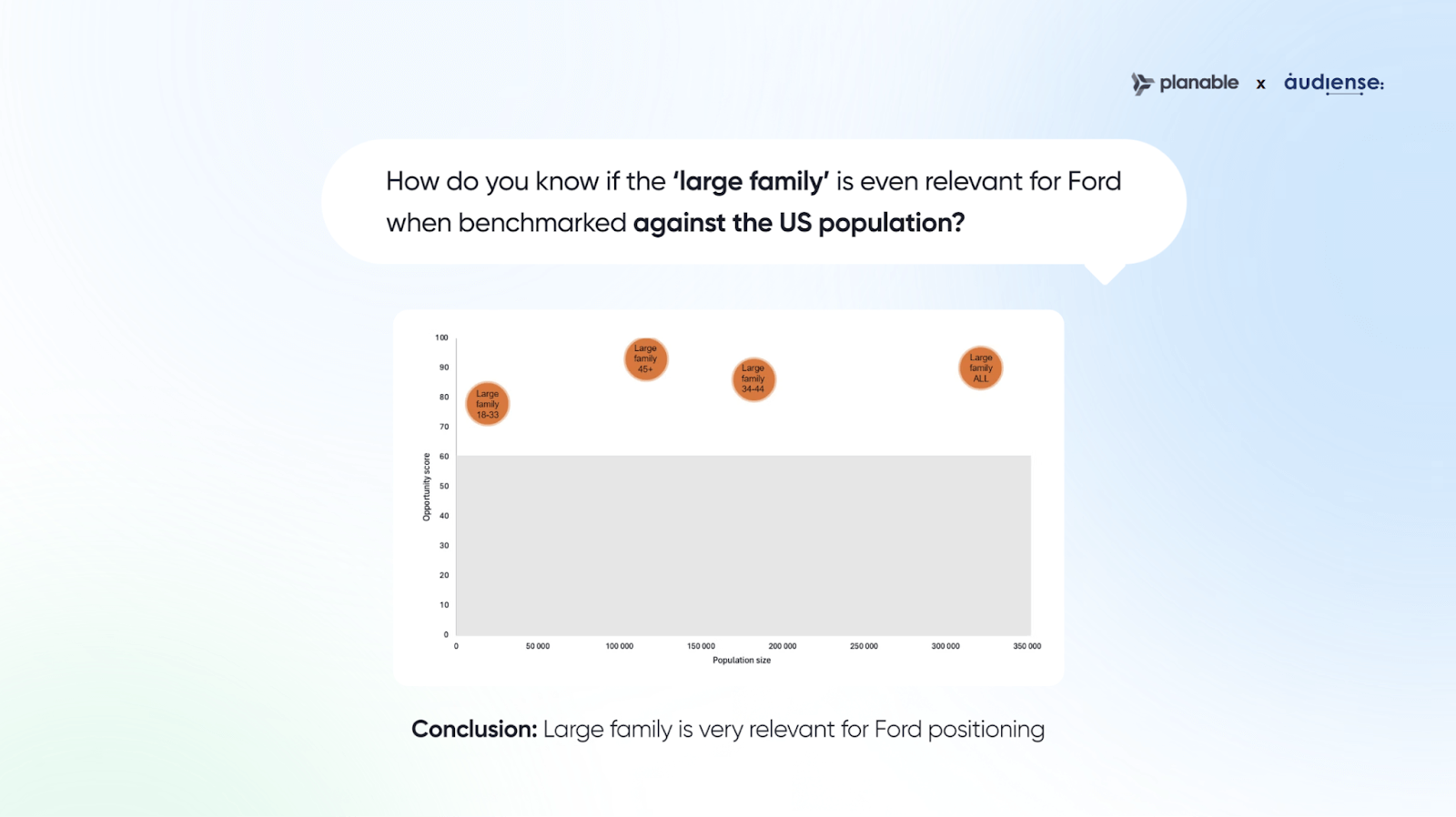

I want to analyze the large family segment in relation to Ford to validate if my persona is relevant or not.

In this case, I can see that every age group associated with the large family is extremely relevant for Ford because the score is over 60 in all cases.

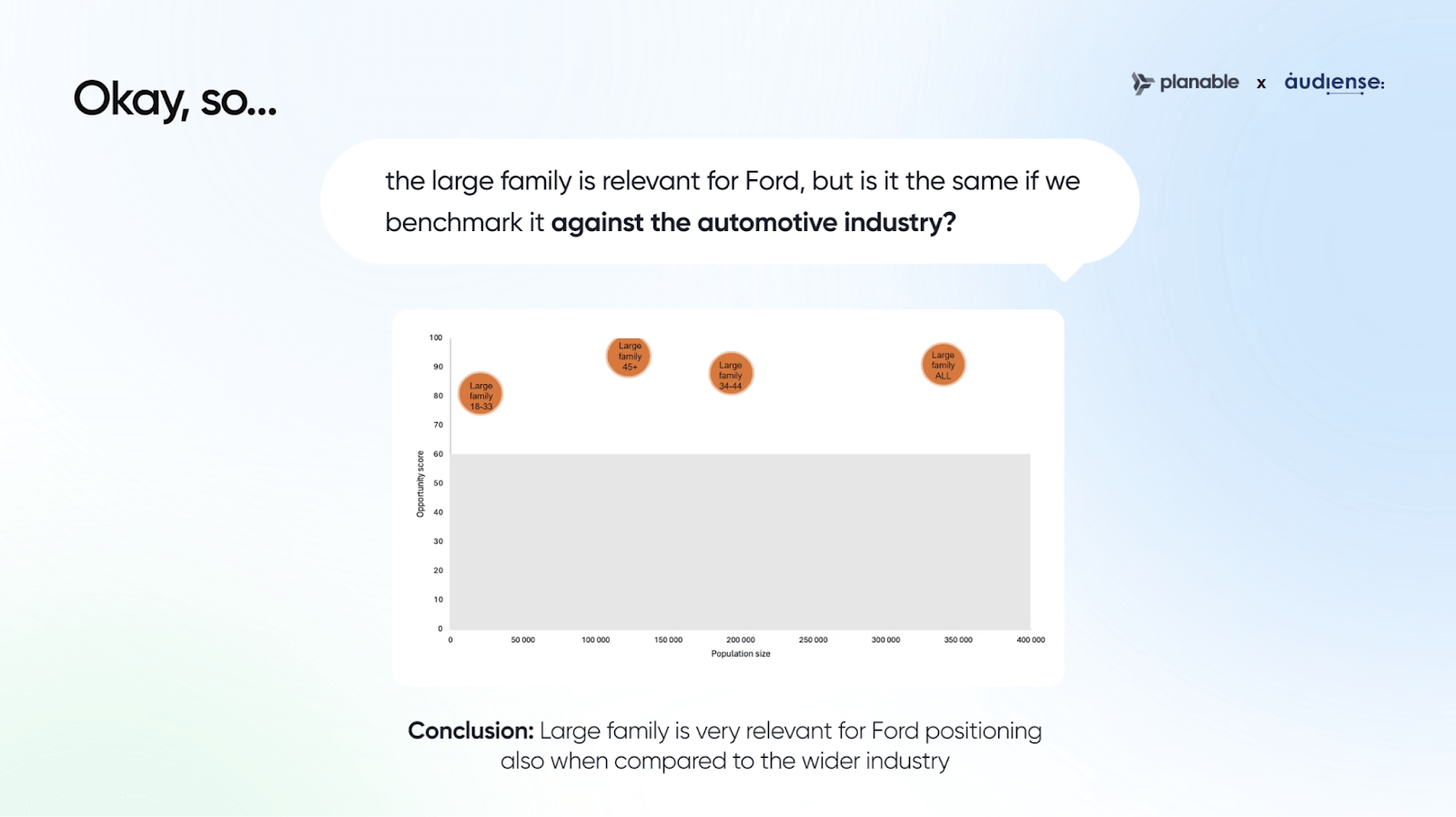

This is a good start, but as we all know, Ford is not alone in the car industry. So, it’s important to analyze the penetration of Ford associated with the large family. And as a benchmark, I now want to select the automotive industry so that I can compare how Ford measures up against the wider industry.

After all, it’s possible that Ford could rank lower in relevance against the industry average than it does against the national average.

Thankfully, that’s not the case here. I can see that Ford still maintains a high relevance score for the large family when compared with the positioning of the automotive industry. And just like before, this applies consistently for every age group associated with the large family segment.

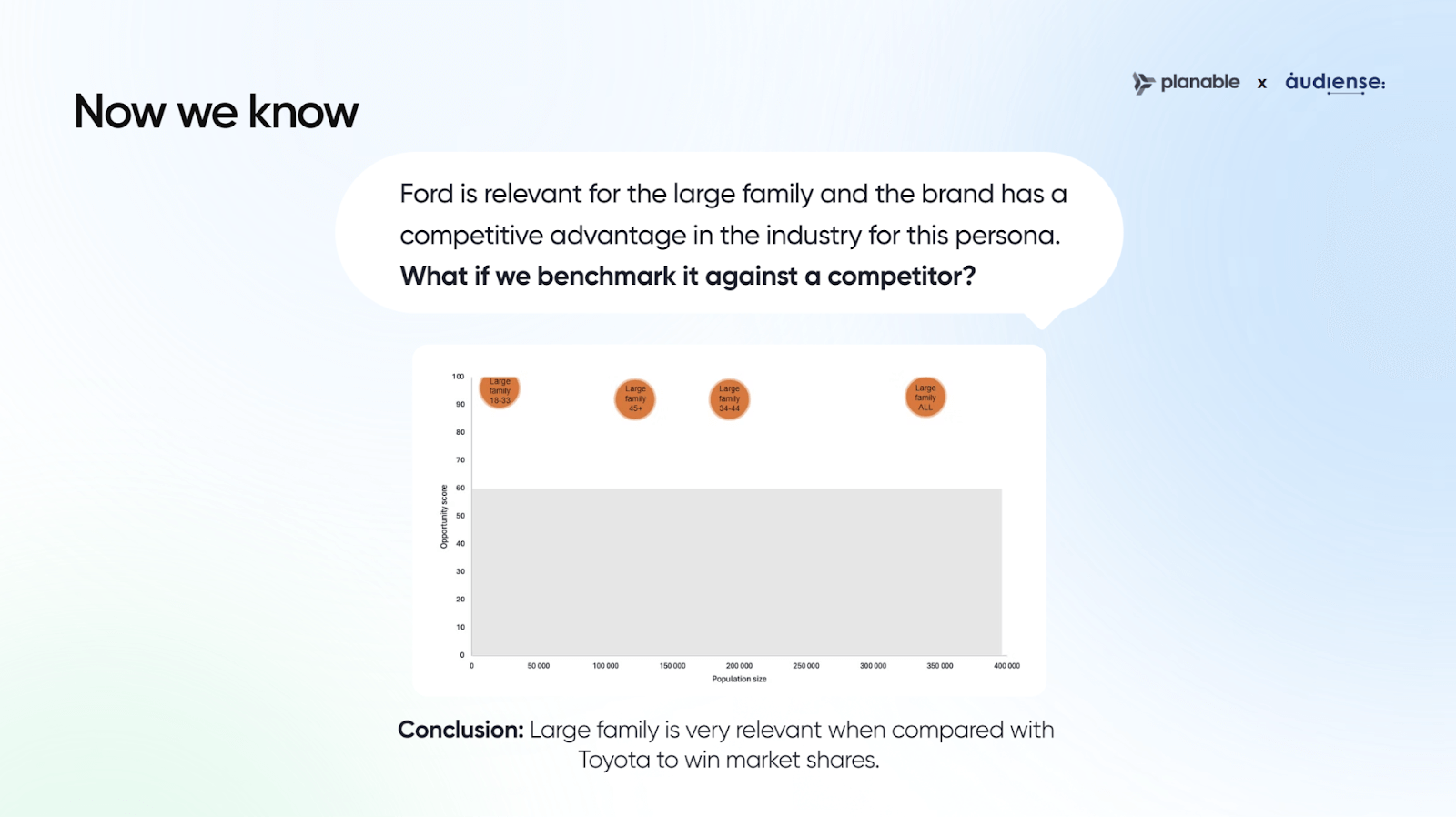

But what about a specific competitor?

I can decide that it’s important to know whether Ford is more relevant than Toyota, for example. So, I take Toyota and check if Ford has better positioning to a large family persona than Toyota.

Again, the results are great and I can confirm that Ford is extremely relevant to the large family persona.

Step 3: creating the brand strategy

Now I’ve validated the positioning, I’m happy to activate the large family as a relevant persona for the Ford brand. So I decide to begin a new project which is all about convincing a large family to buy a new Ford car.

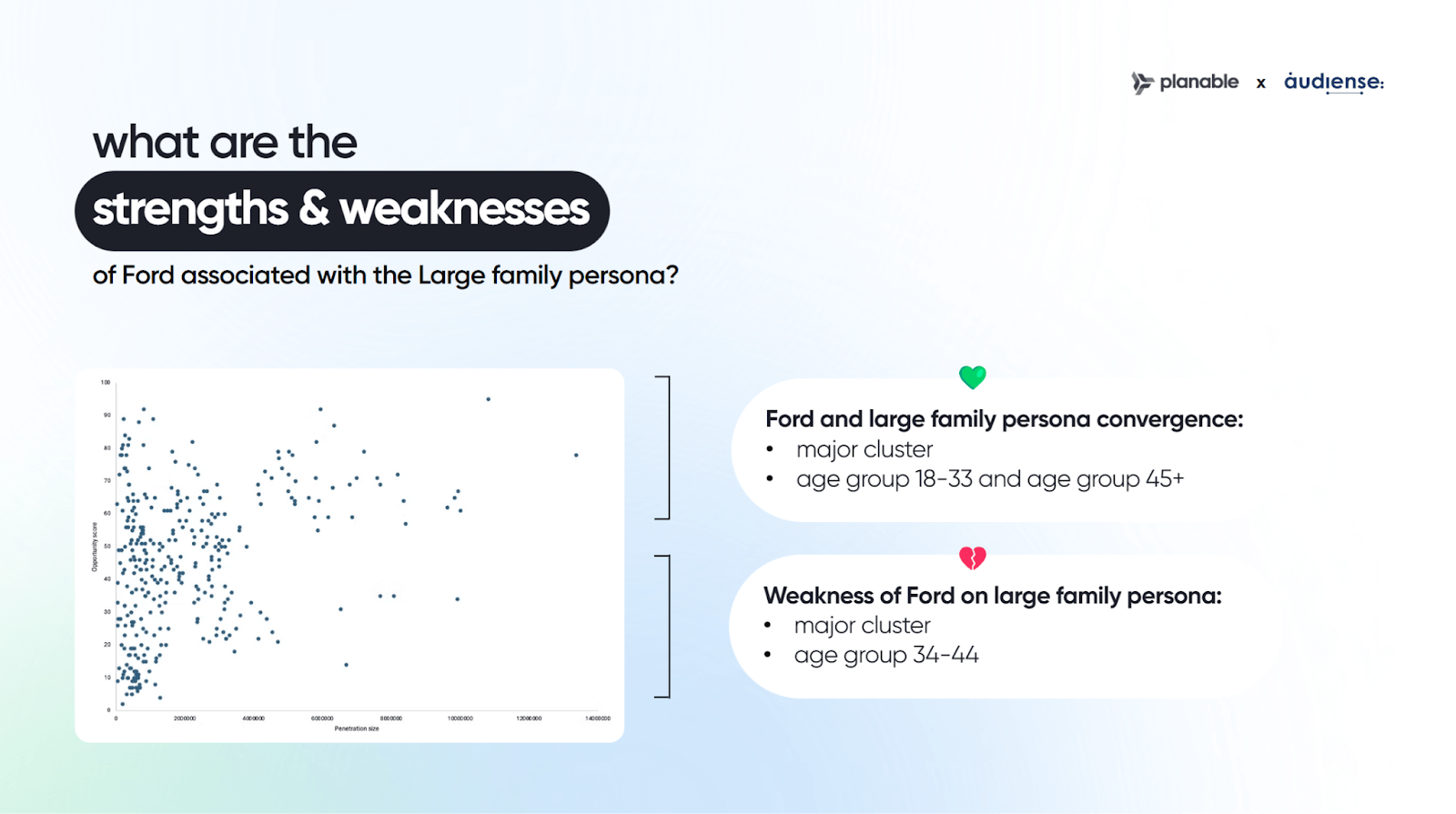

It’s time to develop the brand strategy. The benchmark I use to help me will be very different in this case. That’s because I need to understand what the major differences between Ford and the large family persona I want to target.

So, I’ll use the large family persona as a benchmark to see where I have some convergence between Ford and my goal.

For this example, I include various metrics to validate different clusters and segmentations. I’m able to identify an important point that may have gone overlooked without this step – Ford and the large family persona converge in just two different age groups.

The first is the 18-33 group and the second is the 45+ group. However, there is a weakness detected for large families in the 34-44 age group. I can see directly that, in this group, there is no correspondence and no convergence between Ford and the large family persona.

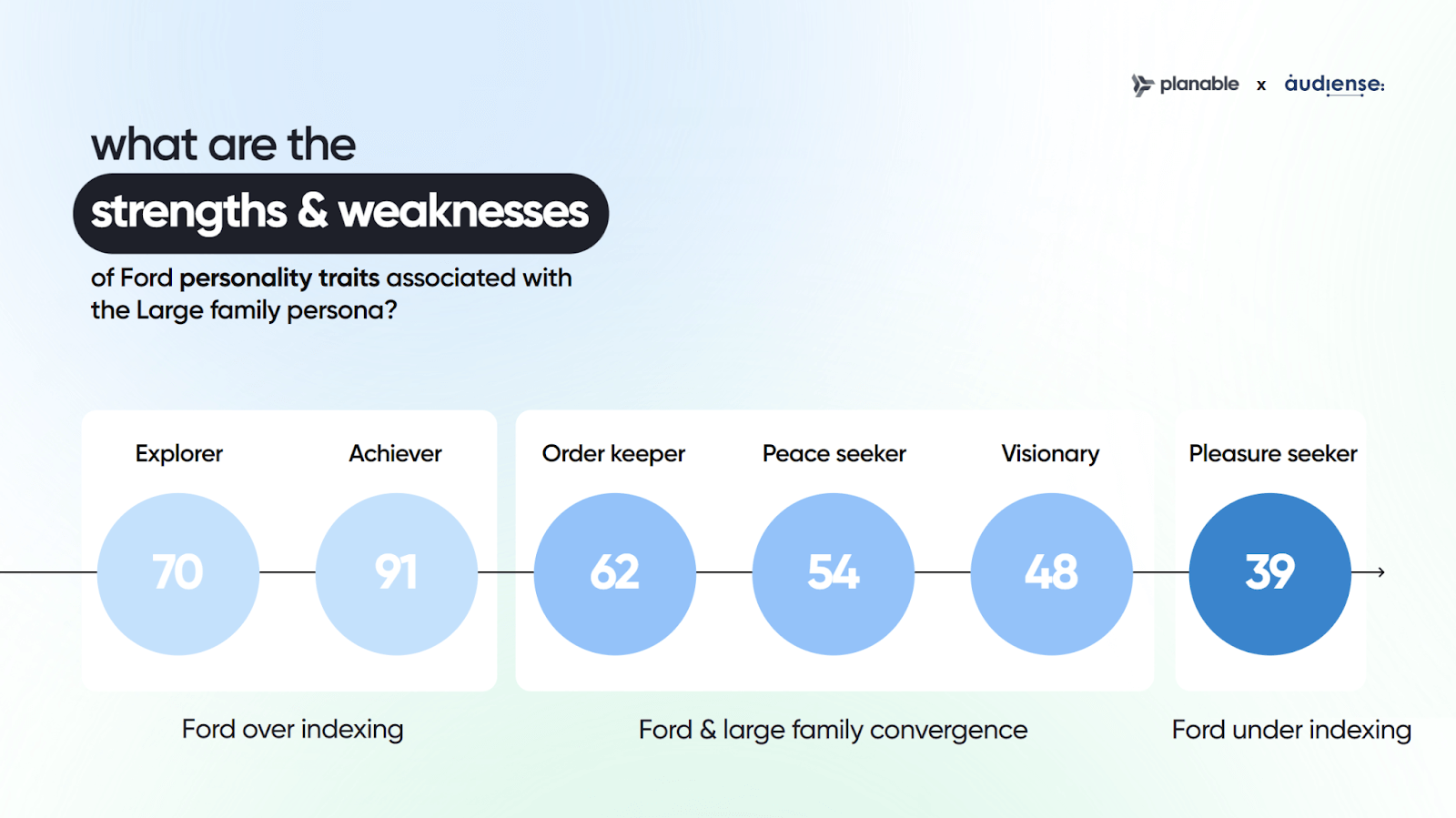

Finally, I want to identify any convergence for different personality types.

The most important one to note in my Ford example is the pleasure seeker. This is one of the biggest personality threats associated with the large family persona, since it’s not associated with Ford.

This tells me that if I want to develop a specific brand positioning to convince the large family persona to buy a new Ford car, I will need to work on a particular positioning for the pleasure seeker since that is currently a weak point for my brand within this audience.

With a background as a research fellow at Liege University in Belgium, specializing in Political Science, Gregory has dedicated 7 years to understanding the intricacies of decision-making processes. Following the completion of his Ph.D., he launched a consultancy in 2016, where he collaborated with prominent brands and industries, crafting strategies for brand positioning, conducting comprehensive competitive analysis, and leveraging audience intelligence to empower decision-makers. Joining SOPRISM in 2021, he now leads Consulting & Research at Audiense post-acquisition, driving strategic solutions.